Legal Malpractice Insurance Cost

Practicing law is a demanding profession that requires vast and intricate knowledge of the court system. Even lawyers with the most experience and greatest resources make mistakes. Additionally, clients unhappy with the result of their case may blame their attorneys. Legal malpractice insurance is an essential tool for managing these potential claims.

In this guide, we will provide information about legal malpractice insurance cost to help you make the best decision about your own policy.

We Cover in This Guide

- How much does legal malpractice insurance cost?

- What is legal malpractice insurance?

- What does legal malpractice insurance cover?

- Benefits and risks

- The potential cost of being uninsured

- Tips for buying

- FAQ

- Summary

- All types of insurance you may need

How Much Does Legal Malpractice Insurance Cost?

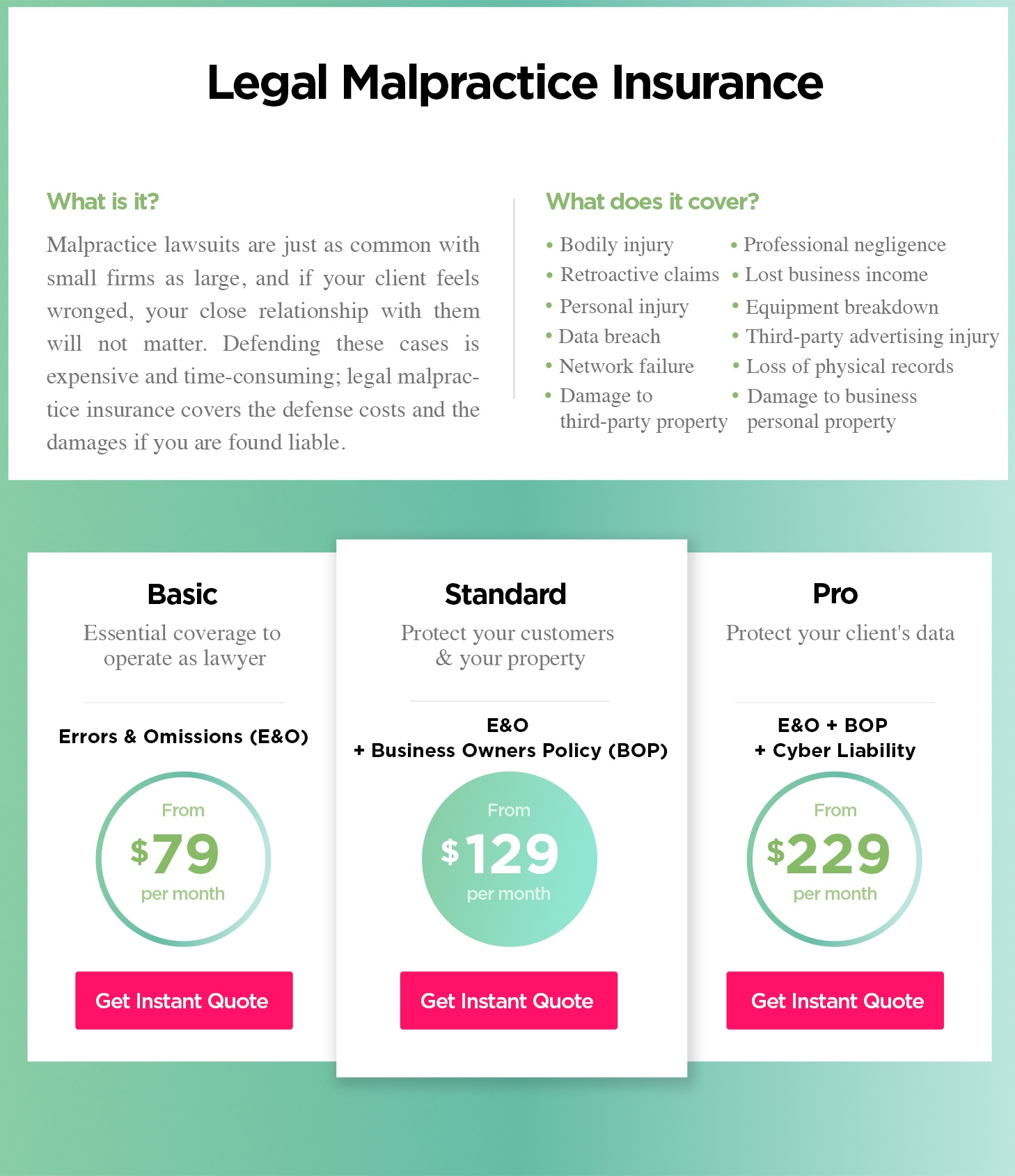

Legal malpractice insurance cost depends on a number of factors. The first of which is the type of law practiced: criminal and insurance lawyers have the lowest premiums, while securities placement, class action, and intellectual property attorneys’ premiums are higher. Premium costs start at $79 per month and can reach $500 per month.

Some additional factors that impact your rate are claims history, number of lawyers in the firm, years of coverage, limits, risk management practices, and location.

The premium prices for common legal malpractice policies are:

What is Legal Malpractice Insurance?

Legal malpractice insurance is the best way to cover your practice against the near-inevitability of a malpractice claim. Malpractice lawsuits are just as common with small firms as large, and if your client feels wronged, your close relationship with them will not matter. Defending these cases is expensive and time-consuming; malpractice insurance covers the defense costs and the damages if you are found liable.

What Does Legal Malpractice Insurance Cover?

The specifics of your malpractice insurance coverage will depend on your provider and the policy you choose, but many plans protect your firm and individual attorneys against the following claims:

- Professional negligence

- Retroactive claims

- Bodily injury

- Damage to third-party property

- Damage to business personal property

- Personal injury

- Lost business income

- Equipment breakdown coverage

- Data breach

- Third-party advertising injury

- Network failure

- Loss of physical records or devices

While legal malpractice insurance can protect you from many scenarios, certain actions are not covered, including:

- Fraudulent, criminal, dishonest, or malicious acts

- Services provided to businesses controlled or owned by the insured firm or attorney

- Fiduciary duties to retirement plans covered under ERISA

- Claims or lawsuits between lawyers at the same insured firm

- Undisclosed old cases that might lead to claims

Benefits and Risks

- Protection against lawsuits: Whether you practice civil or criminal law, the results of a legal case are extremely significant. If your mistake leads to a poor outcome, your client may sue. Legal malpractice insurance provides coverage to defend a lawsuit and cover any damages.

- Peace of mind: Knowing that their firm has comprehensive malpractice insurance will allow an attorney to focus on the work and present the best case for their client.

- Compliance: Many states have minimum insurance mandates for lawyers. Additionally, some states often require firms to disclose their lack of coverage to potential clients.

The Potential Cost of Being Uninsured

No matter how careful and professional a lawyer is, they may face a legal malpractice claim at some point in their career. These lawsuits can damage the reputation of your firm and may cause you to lose clients.

In addition to the cost of legal defense and damages, the attention required to fight a lawsuit can distract you from work that’s actually bringing in income. The security of malpractice insurance will allow you to focus on current clients who actually need and want your services.

Tips for Buying

When considering legal malpractice insurance cost, keep the following in mind before making your decision:

- Identify your risks: Be sure to thoroughly analyze your firm, considering your size and the types of law you practice, to identify potential risks. After that, choose the proper limits and include all the applicable coverages.

- Work with an independent agent: An independent insurance agent will help direct you toward providers with the best rates and those that have the most experience with legal malpractice insurance for your practice’s needs.

- Compare quotes: Policy costs vary between insurers. Consider several quotes to find the best rates and coverage.

FAQ

Do I need workers’ compensation insurance?

While the risk of injuries in the legal profession seems low, accidents do occur. Additionally, most states require you to have workers’ compensation insurance if you employ at least two people.

What insurance do I need to cover employees using their private cars to go to court?

Personal auto insurance does not cover damages for activity done while on the job. Commercial auto insurance is necessary to protect your employees in case of an accident.

Do I need malpractice insurance?

In addition to providing the resources to defend yourself in court and cover potential damages, malpractice insurance will help uphold your professional reputation from the negative publicity of such lawsuits.

Summary

Despite one’s best efforts, malpractice lawsuits are an almost unavoidable risk of the profession. Legal malpractice insurance protects your firm against potential financial ruin from such claims.

By understanding legal malpractice insurance cost and determining the needs of your firm, you can know that your policy covers all potential risks and feel secure knowing that you are protected.

All Types of Insurance You May Need

|

|

|

|

|

$89/Month

Errors & Omissions (E&O)